Table of Contents

- 2024 Social Security Income

- 0 Increase for Social Security in January 2024 – Who is Eligible for ...

- HUGE CHANGES! Social Security INCREASE by Double Tax Elimination - SSI ...

- Bigger Social Security COLA, Bigger Taxes For Retirees

- What the 2024 Social Security COLA Could Mean for Your Retirement ...

- Which States Tax Social Security in 2024 - YouTube

- Which States Tax Social Security in 2024 - YouTube

- Social Security Increase 2024 Increase - Deedee Mildred

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

- Social Security Withholding For 2024 Form - Rosie Claretta

What is the Social Security Wage Base?

How Does the Social Security Wage Base Affect Employees?

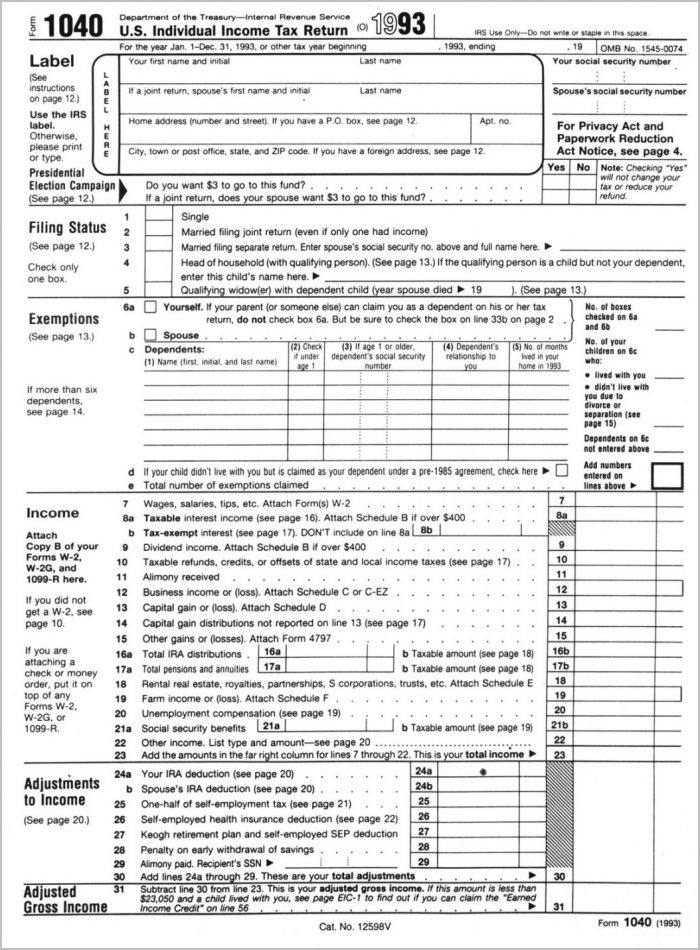

How Does the Social Security Wage Base Affect Self-Employed Individuals?

Self-employed individuals, on the other hand, pay both the employee and employer portions of Social Security taxes, which is 12.4% of their net earnings from self-employment. Like employees, self-employed individuals only pay Social Security taxes on their earnings up to the wage base. However, self-employed individuals may be able to deduct half of their Social Security taxes as a business expense on their tax return.

Implications of the Social Security Wage Base

The Social Security wage base has significant implications for employees and self-employed individuals. For high-income earners, the wage base can result in significant tax savings. However, it also means that they do not pay into the Social Security system on their earnings above the wage base, which can affect their future Social Security benefits. For self-employed individuals, the wage base can affect their business expenses and tax liability. In conclusion, the Social Security wage base is an essential concept for employees and self-employed individuals to understand. By knowing the wage base and how it affects their taxes, individuals can plan their finances accordingly and make informed decisions about their earnings and tax liability. Whether you're an employee or self-employed, it's crucial to stay up-to-date on the latest changes to the Social Security wage base and how it may impact your taxes and future Social Security benefits.For more information on the Social Security wage base and how it affects your taxes, consult with a tax professional or visit the Social Security Administration website. Stay informed, and plan your finances wisely.