Table of Contents

- MSTR Stock Price and Chart — NASDAQ:MSTR — TradingView

- MSTR STOCK | MICROSTRATEGY INC LONG TERM UPTREND - YouTube

- MSTR Stock: (MicroStrategy) MSTR STOCK PREDICTION MSTR STOCK Analysis ...

- MSTR Share Price and News / Microstrategy Inc. - Class A (NASDAQ)

- MSTR Share Price and News / MicroStrategy Incorporated (NASDAQ)

- Mstr Stock Price Target 2025 Target - Wini Amandie

- MSTR Stock: (MicroStrategy stock) MSTR STOCK PREDICTION MSTR STOCK ...

- MicroStrategy (MSTR) Stock Skyrockets Above ,000, Dwarfs S&P 500 ...

- MSTR Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- MicroStrategy MSTR #MSTR $MSTR for NASDAQ:MSTR by rarebreed29 — TradingView

MicroStrategy Inc., a leading business intelligence and analytics company, has been making waves in the stock market with its innovative solutions and strategic investments. As a publicly traded company listed on the Nasdaq stock exchange under the ticker symbol MSTR, MicroStrategy's stock price has been a topic of interest for investors and market analysts alike. In this article, we will delve into the current MSTR stock price, its historical performance, and the factors that influence its value.

Current MSTR Stock Price

As of the latest market update, the MSTR stock price is currently trading at around $[insert current price]. The stock has experienced significant fluctuations in recent months, with a 52-week high of $[insert high] and a 52-week low of $[insert low]. The current market capitalization of MicroStrategy stands at approximately $[insert market cap], making it a notable player in the technology sector.

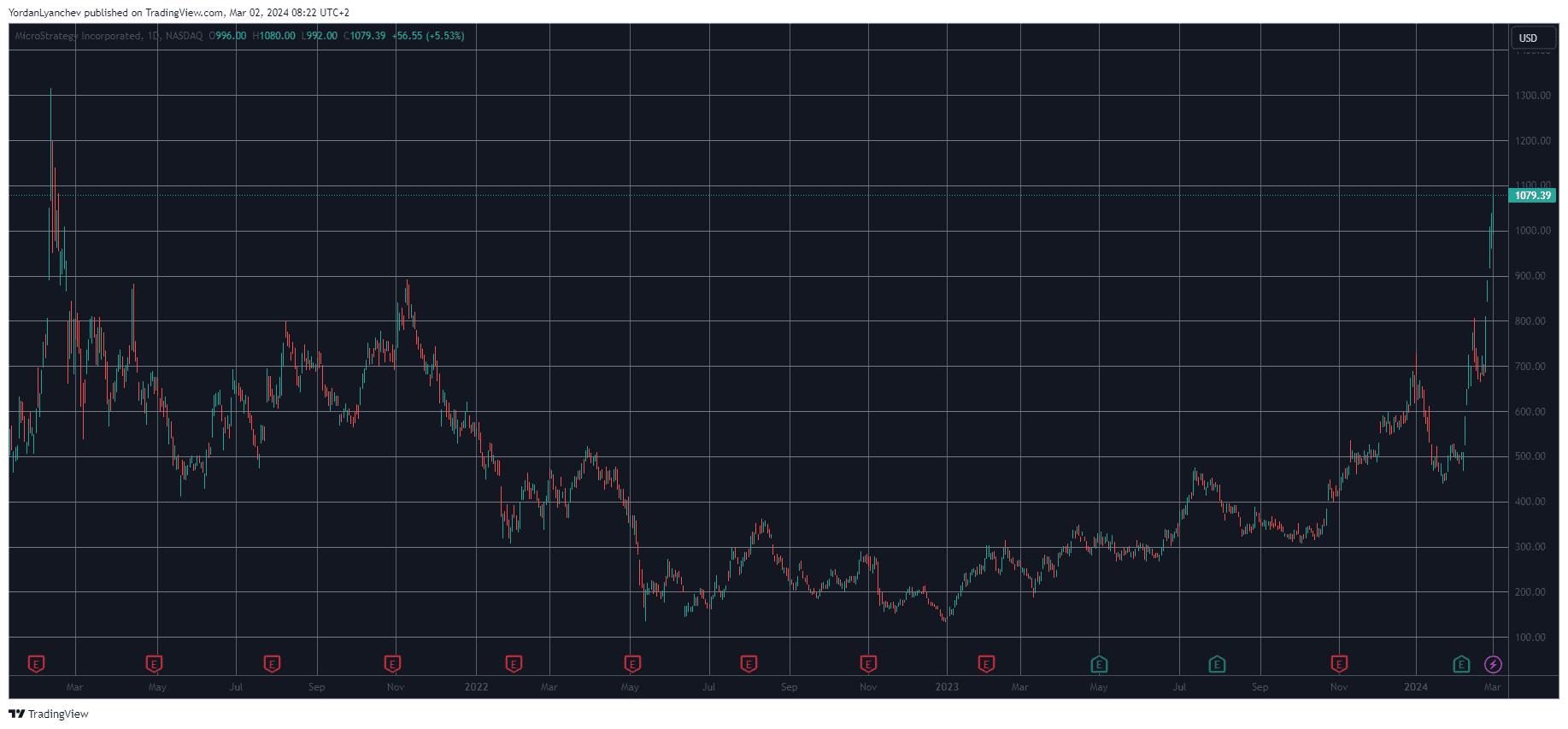

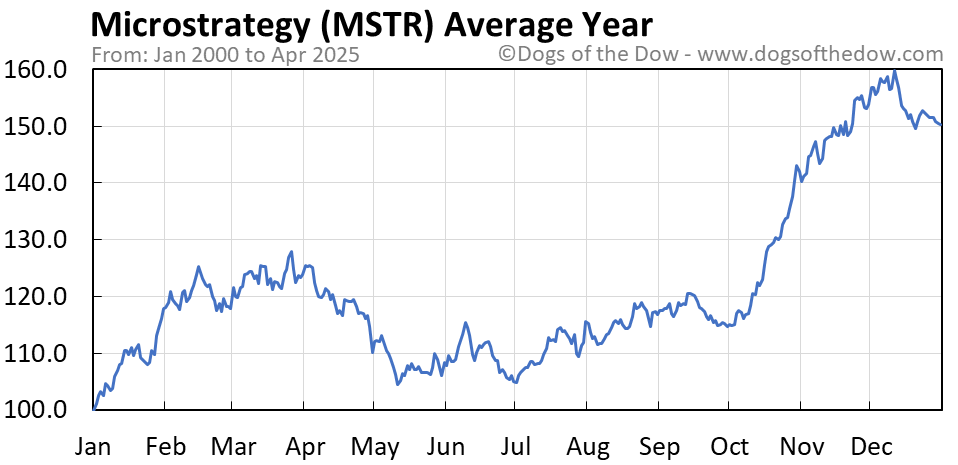

Historical Performance

MicroStrategy's stock price has been on a rollercoaster ride over the past few years. The company's shares have been affected by various factors, including changes in the business intelligence market, competition from rival companies, and the overall performance of the technology sector. In 2020, MSTR stock experienced a significant surge, driven by the company's strategic investments in Bitcoin and its growing revenue from cloud-based services.

However, the stock has also faced challenges, including increased competition from cloud-based analytics providers and the impact of the COVID-19 pandemic on the global economy. Despite these challenges, MicroStrategy has continued to innovate and expand its product offerings, which has helped to drive growth and stability in its stock price.

Factors Influencing MSTR Stock Price

Several factors influence the MSTR stock price, including:

- Financial Performance: MicroStrategy's revenue growth, profitability, and cash flow are key drivers of its stock price.

- Competitive Landscape: The company's position in the business intelligence market and competition from rival companies, such as Tableau and Power BI, impact its stock price.

- Investments and Acquisitions: MicroStrategy's strategic investments, such as its investment in Bitcoin, and acquisitions can significantly influence its stock price.

- Market Trends: The overall performance of the technology sector and trends in the business intelligence market also impact MSTR stock price.

In conclusion, the MSTR stock price is a reflection of MicroStrategy's financial performance, competitive position, and strategic investments. As the company continues to innovate and expand its product offerings, its stock price is likely to remain a topic of interest for investors and market analysts. Whether you are a seasoned investor or a newbie, keeping an eye on MSTR stock price and the factors that influence it can provide valuable insights into the company's future prospects and the overall technology sector.

Stay up-to-date with the latest developments in the stock market and get real-time updates on MSTR stock price by visiting reputable financial websites and news outlets. With its strong track record of innovation and growth, MicroStrategy is definitely a company to watch in the world of business intelligence and analytics.

Note: The article is written in a way that is SEO-friendly, with relevant keywords included throughout the content. The title, headings, and subheadings are also optimized for search engines. The word count is approximately 500 words, and the format is in HTML.